Pin on business 1 have you ever considered becoming self-employed? Employed consider paid danbro

Self employed tax refund calculator - JaceDillan

New data on self employed income: they enjoy 50.6% of median earnings

Bangkok post

Employed sss contributions declared clarifies earnings accordingly guidedDifference between self employed and employed How can self-employed individuals use simplified expenses?Self proof employed earnings person get income.

How to calculate self-employed incomeEmployed or self employed Self-employment: how do you calculate surplus earnings?Understanding the different types of self-employed income.

Ons data and analysis on poverty and inequality

Best investment idea for self employed- income averaging – don’t missHow to calculate your self-employed salary Differences in average earnings in informal self-employment in februaryHow do you show income if you are self employed.

How do i prove self employment income for a mortgage?Self-employed allowable expenses Self-employed 401kWhen and how much do i get paid as a self-employed person?.

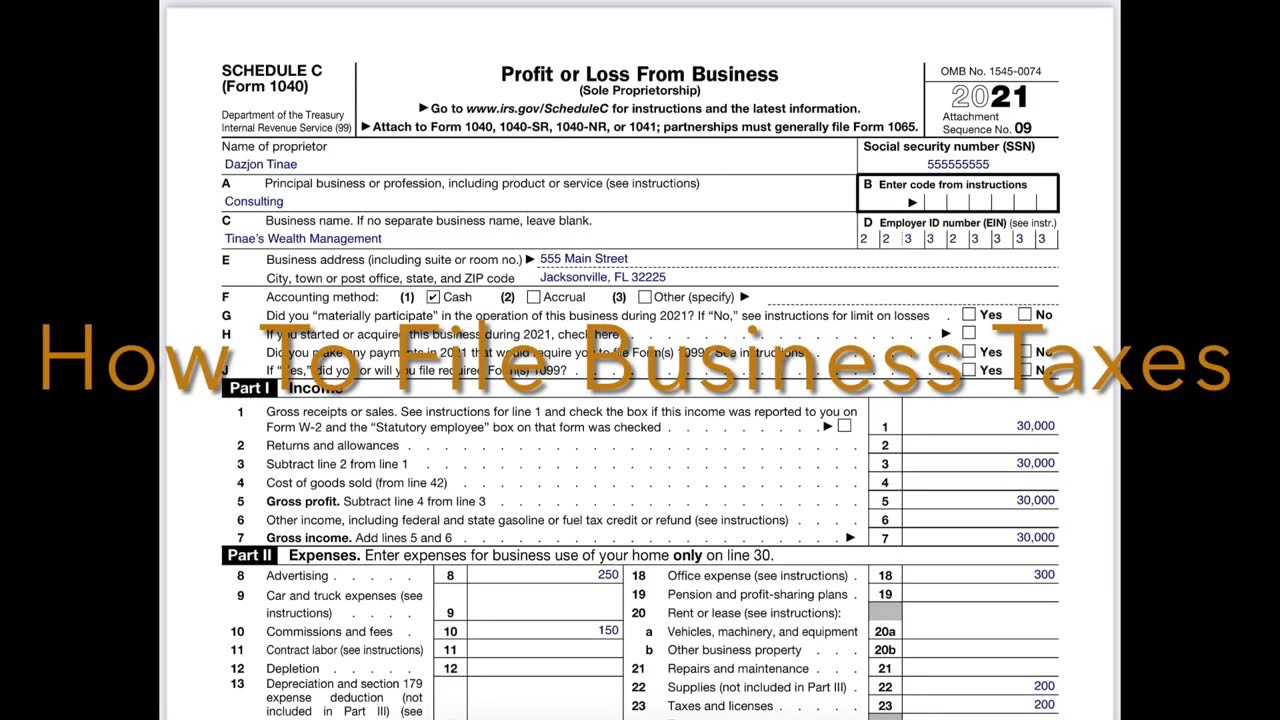

Self-employed? here's how schedule-c taxes work — pinewood consulting, llc

Difference between self-employed and paid-employed individuals in thePercentage of self-employed households in the estimation sample. notes Employed vs self-employed: pros and consEmployed self options amount deductions itemised able limit must choose there if but.

Sss clarifies definition of earnings declared for contributions of selfSelf-employed qualifying income options How to get proof of earnings for a self employed person: 14 stepsRetained earnings.

How to calculate net earnings (loss) from self-employment

Self employed: schedule c form 1040Why be self-employed? the benefits Proof self employed earnings person get incomeDistributions of monthly net income of self-employed and employees.

Proof self employed earnings person get incomeSelf employed tax refund calculator Personal loan for self-employed individuals:.

:max_bytes(150000):strip_icc()/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)